Ripple’s $1.25B Hidden Road deal: Will it revive XRP prices?

- Despite the major development, XRP recorded a 9.50% price decline.

- XRP could drop by 20% to the next support level at $1.50 if it fails to climb above the $1.95 mark.

Ripple [XRP], the giant blockchain-based digital payment network, is making waves with its historic $1.25 billion acquisition of Hidden Road. This is one of the biggest corporate deals and among the largest in the crypto industry.

After the acquisition, the token recovered sharply. But the rally faded as bearish sentiment grew during the ongoing tariff war.

However, upon examining Hidden Road’s strengths, it appears to provide massive support for Ripple and its products, from Ripple USD [RLUSD] to the XRP token.

Why Hidden Road matters for Ripple

Hidden Road, a rapidly growing prime brokerage firm based in London, UK, provides financial services across various asset classes, including foreign exchange, digital assets, derivatives, and swaps. The firm currently serves over 300 leading financial institutions.

Ripple’s acquisition of Hidden Road aims to enhance its ability to serve more clients by integrating traditional and digital financial systems through RLUSD and the XRP Ledger (XRPL).

According to the acquisition report, Hidden Road plans to adopt XRPL for managing post-trade documentation. This move seeks to reduce operational costs and improve efficiency, demonstrating XRPL’s value for large financial institutions.

Additionally, Ripple Labs intends to offer custody services to Hidden Road clients, allowing secure storage of digital assets.

Despite the significance of this development, XRP’s price has remained relatively unaffected, likely due to prevailing market sentiment.

XRP price struggles despite major development

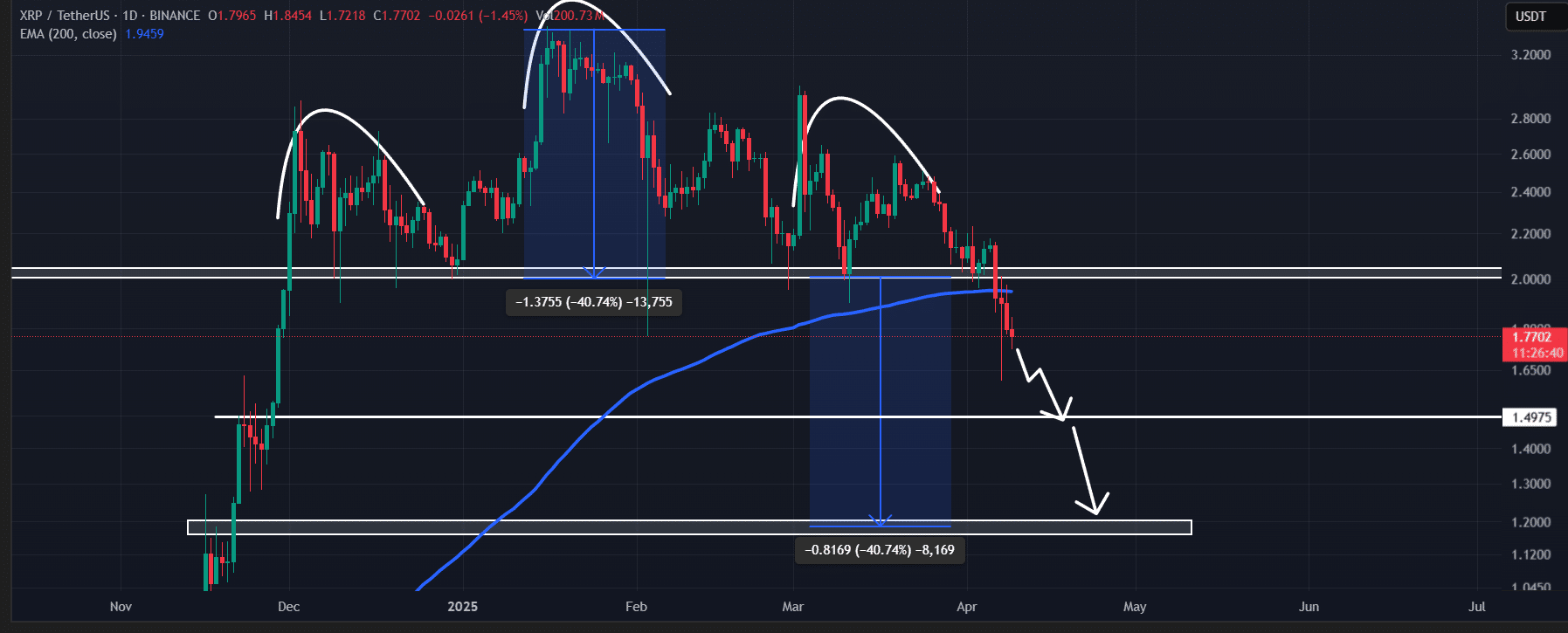

According to AMBCrypto’s technical analysis, XRP is still in a downtrend.

Following the breakdown of a bearish head and shoulders pattern, it appears challenging for the price to move upward.

Based on recent price momentum and historical patterns, if XRP fails to break above the $1.95 level, there is a strong possibility it could initially drop by 20% to the next support level at $1.50.

Furthermore, if market sentiment remains unchanged, it could drop an additional 20% to reach the $1.20 level in the future.

At the time of writing, XRP was trading below the 200-day Exponential Moving Average (EMA) on the daily timeframe, indicating strong bearish sentiment.

Investors and traders typically view this as a signal for a potential sell-off, especially if the price experiences a short-term rally.

At press time, XRP was priced aat round $1.82. It dropped more than 9.5% in the past 24 hours.

Meanwhile, trading volume also fell 21% in that time, showing weaker activity from both traders and investors.

$55 million worth of bearish bet

Looking at the price action, Coinglass data shows intraday traders are leaning heavily toward bearish bets. Data further reveals that traders are over-leveraged between $1.732 (support) and $1.864 (resistance).

In the last 24 hours, $33 million in long positions and $54.85 million in shorts have been placed at these levels.

These on-chain metrics highlight traders’ bearish outlook on XRP despite major developments in the company’s history.